On December 14, 2020, Arvinas released the latest clinical data of ARV-471 and ARV-110, which showed strong therapeutic potential.

As soon as the news was released, Arvinas’s share price doubled, with a market capitalization of $2.4 billion.

As a novel technology area, PROTAC has attracted much attention, a small step in Arvinas means a huge leap in the whole field. Apart from Arvinas, the shares of PROTAC listed biotechnology companies such as Nurix, Kymera, and C4 rose across the board.

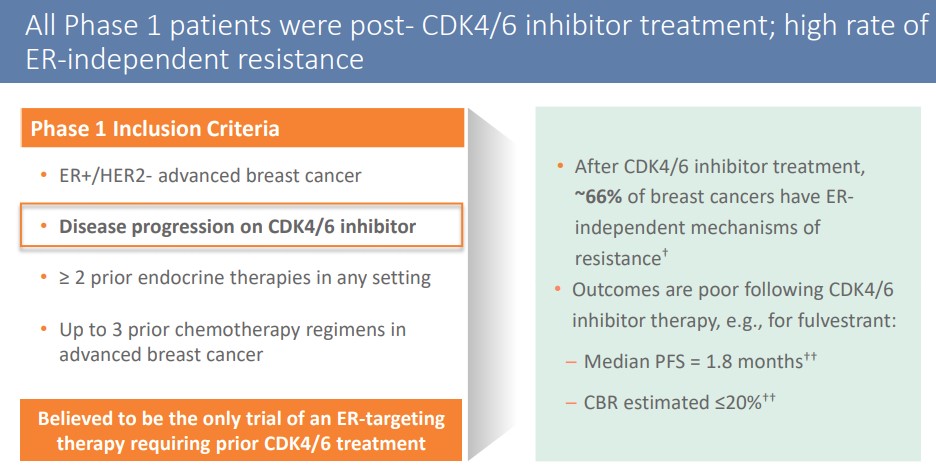

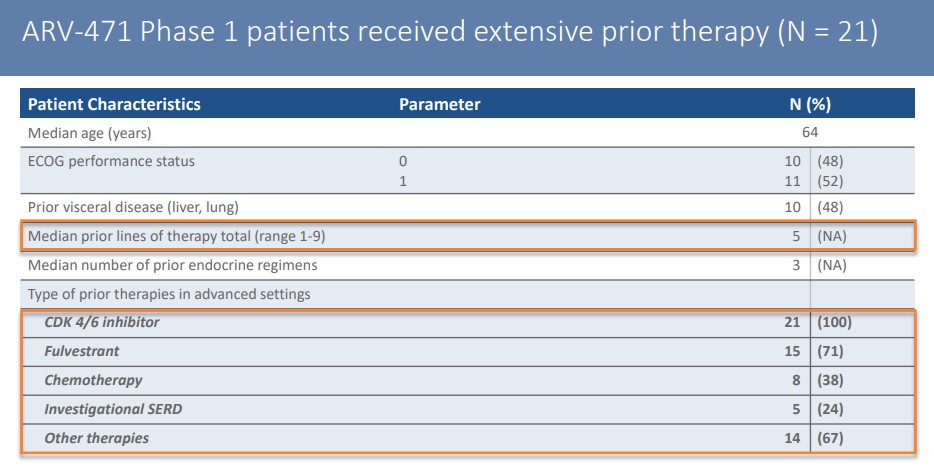

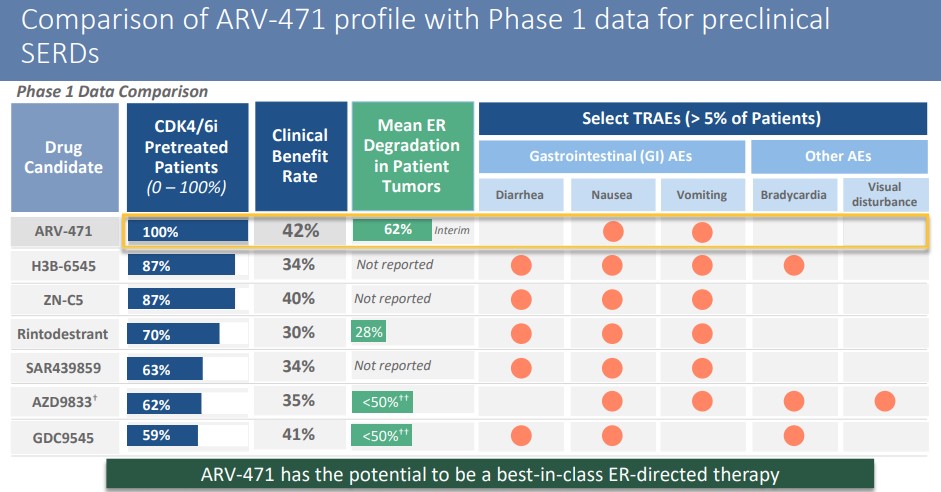

ARV-471’s first-stage clinical test aimed at refractory breast cancer patients who received an average of 5 lines of treatment, 100% received CDK4/6 inhibitors treatment, and 71% received flurvist treatment.

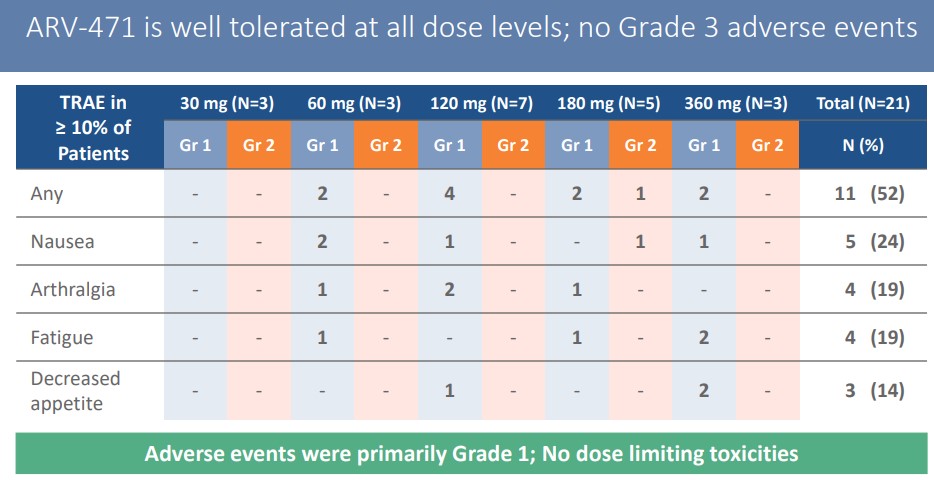

ARV-471 was well tolerated with no grade III or more side effects.

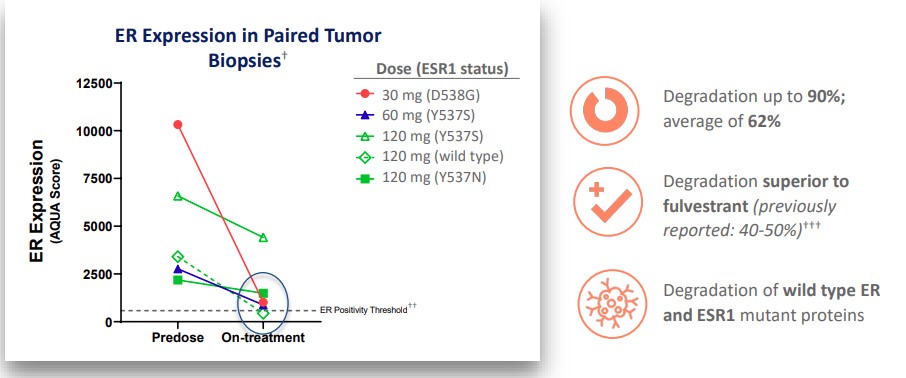

The estrogen receptor was down-regulated by an average of 62%, with a maximum reduction of 90%.

In terms of effectiveness, the clinical benefit rate was 42%, with 1 case of confirmed PR, 2 unconfirmed PR, and 2 SD.

ARV-471 may become the best-in-class estrogen receptor targeting drug.

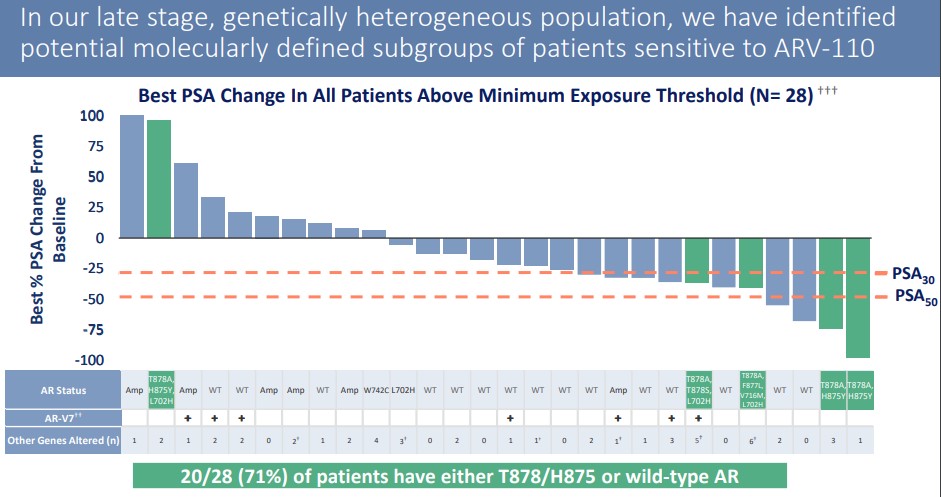

The antigen PSA was effectively down-regulated in patients using ARV-110, and the down-regulation was more than 50% in 4 patients. This range is also of great significance for patients who have received multi-line therapy.

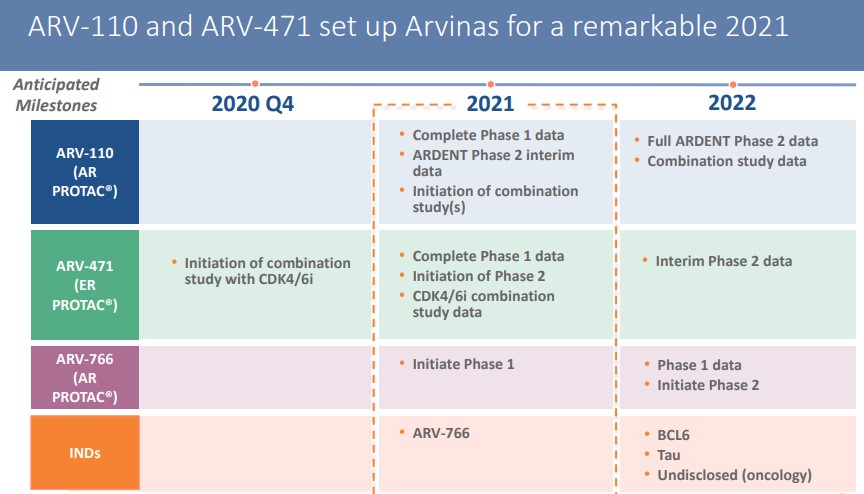

In 2021, Arvinas will set more clinical research targets, including clinical trials related to ARV-110 and ARV-471.

PROTAC has a relatively short history that it was first proposed and applied in 2001, and the first small molecule PROTAC appeared in 2008. The real construction of effective drug candidates started in recent years. The efficacy signal of ARV-471 is of pivotal significance to the entire PROTAC industry, and its follow-up clinical progress will also guide the research in PROTAC.

* The data are all from Arvinas.