Great Achievements Have Been Made in Cancer Drug Listing

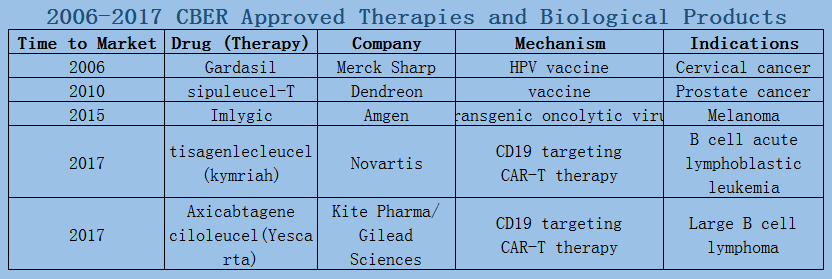

In 2006-2017, a total of 89 oncology therapies (NTDs) were approved by the Center for Drug Evaluation and Research (CDER). The Biologics Evaluation and Research Center (CBER) approved five therapies, including three vaccines and two CAR-T therapies.

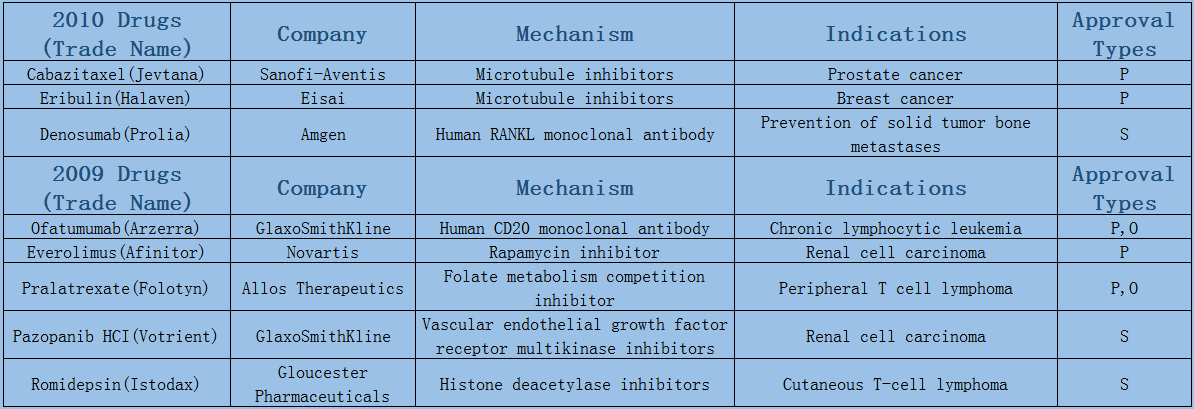

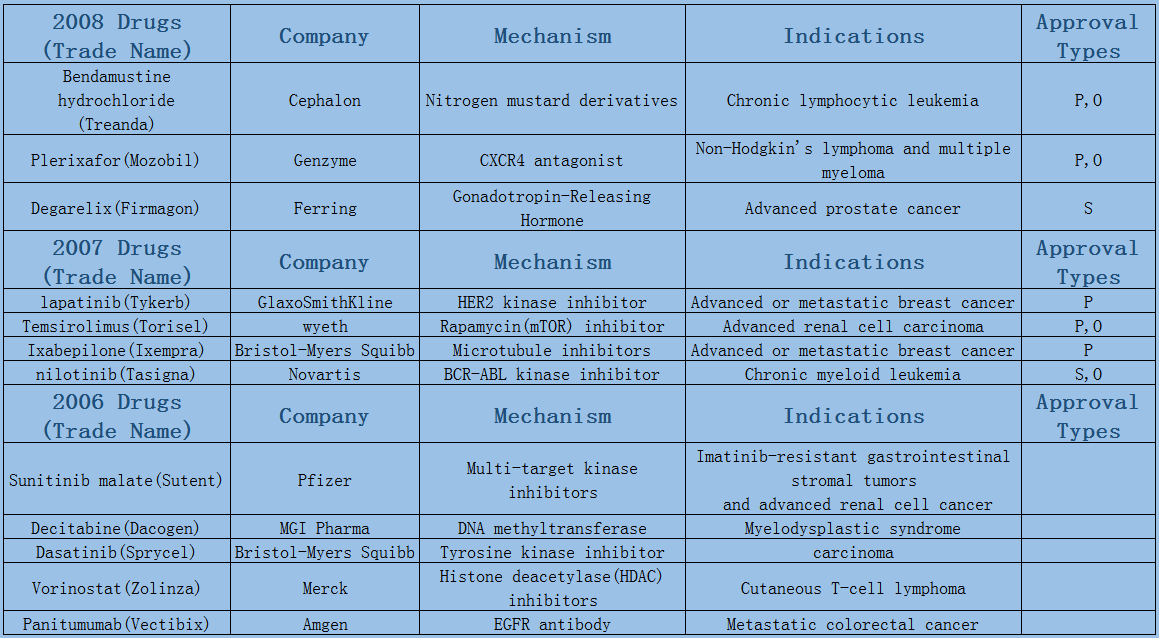

Expect the small fluctuations in 2016 led by approval duration, the average annual number of oncology drugs listed on the market maintains at 8 or 9. Among them, 6 or 7 are small molecule drugs, most of which are targeted drugs such as protein kinase inhibition, and few chemotherapeutic drugs have been on the market since the two microtubule inhibitors were launched in 2010.

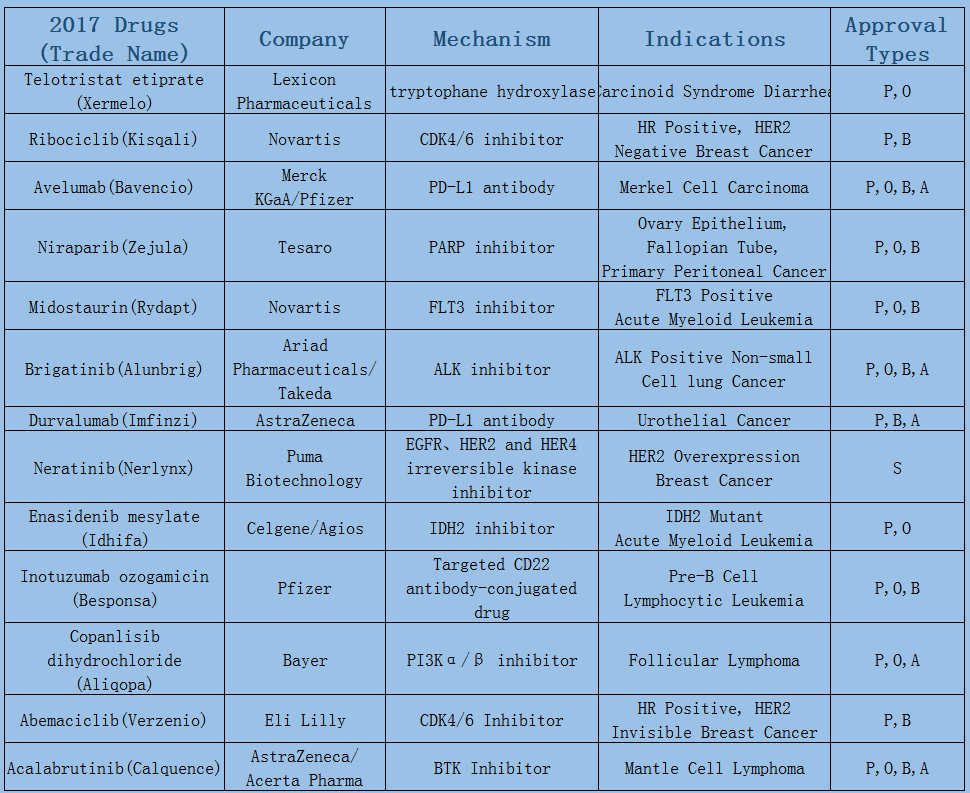

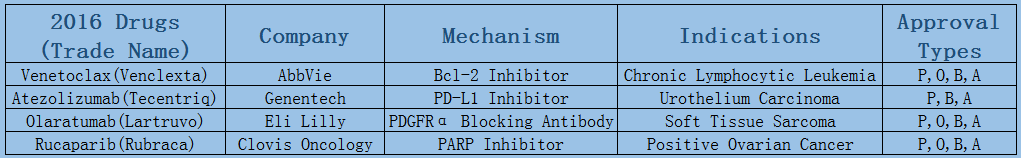

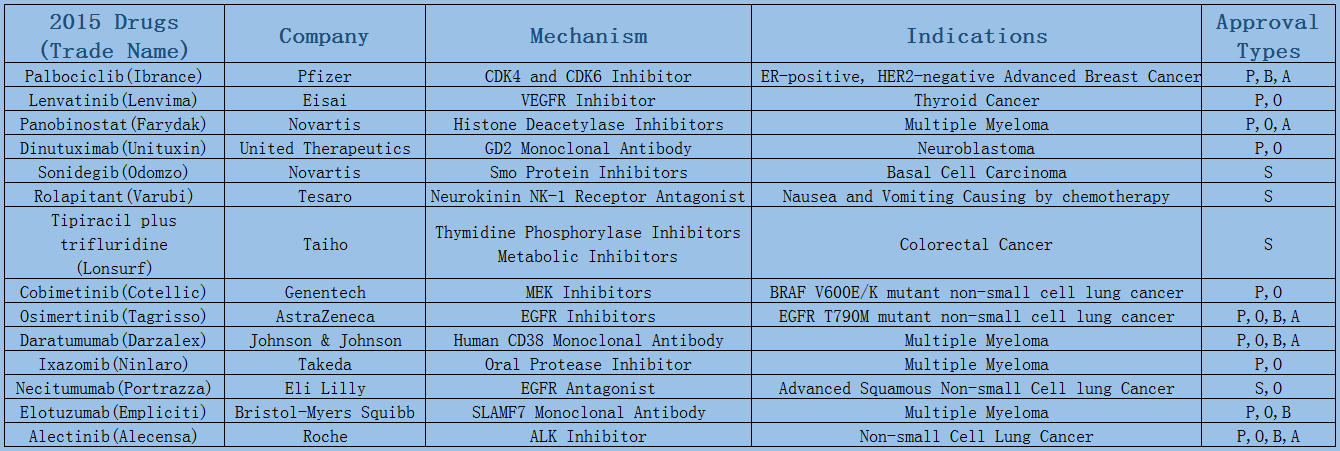

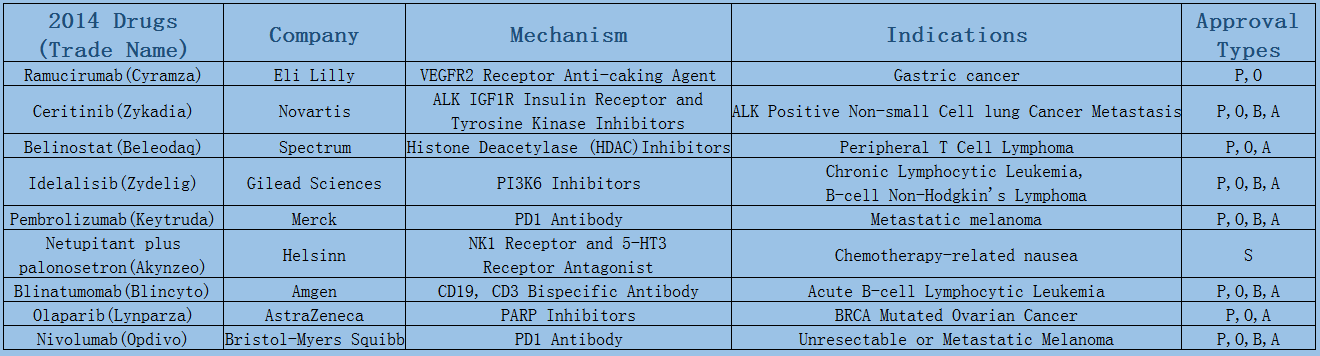

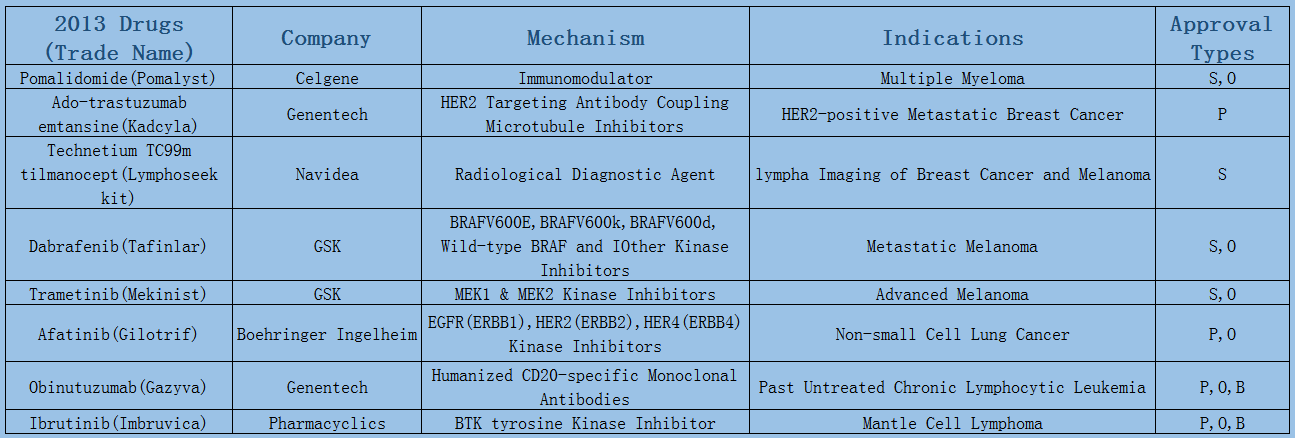

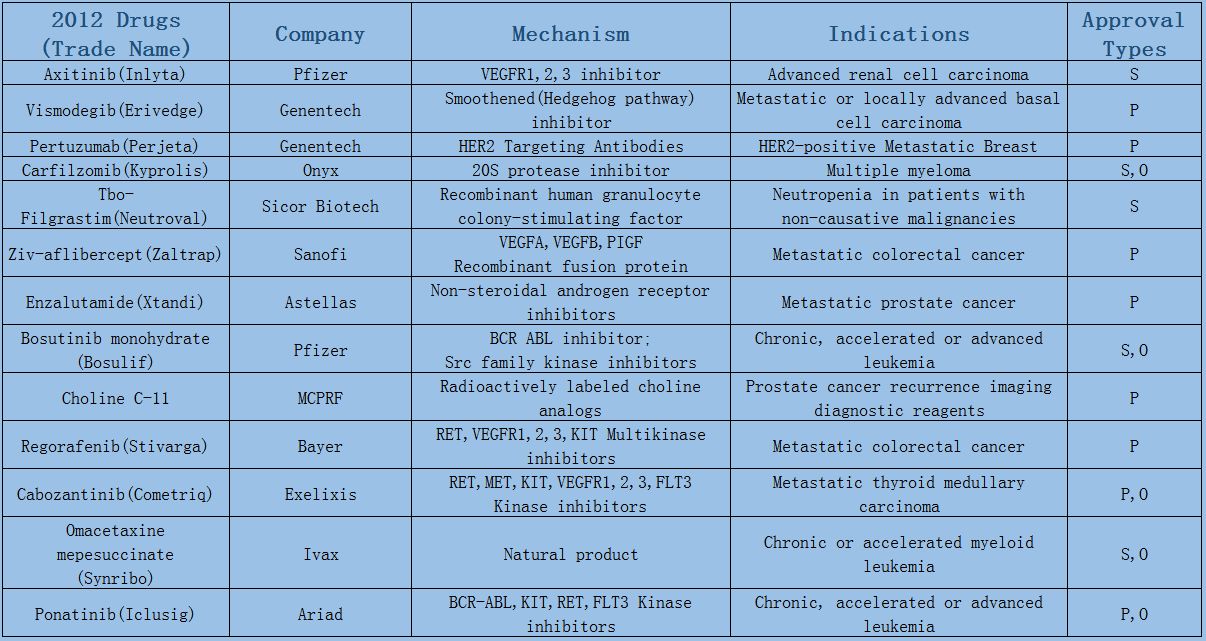

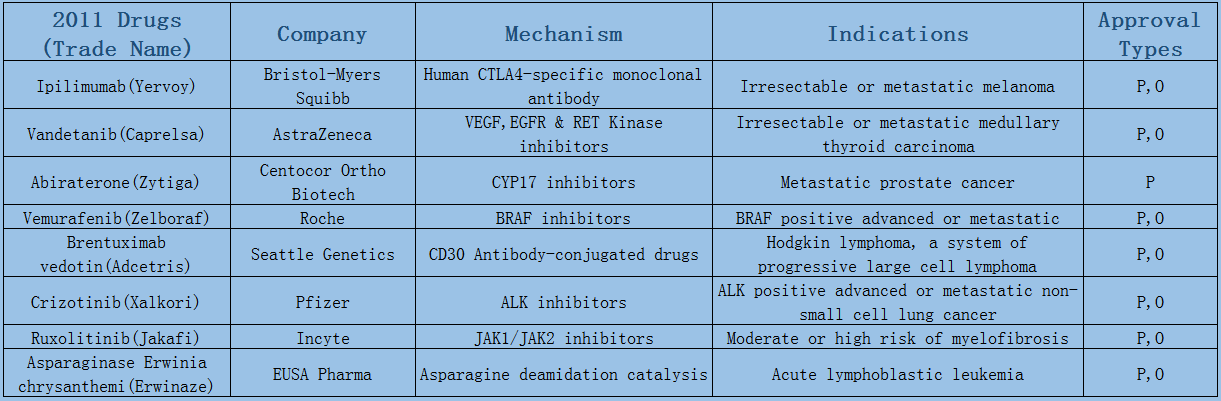

2006-2017 FDA approved antitumor drug targets, indications, approval types are listed below. (O: Orphan Drugs, P: Priority Review, A: Accelerated Approval, B: Breakthrough Therapy)

With the rapid development of biological technology, there is a more thorough understanding of the complex disease mechanisms such as cancer. The policy of orphan medicine is being tilted. The focus of research and development of drugs gradually deviates from cardiovascular and anti-bacterial drugs to tumors, immunology, nervous system and orphan medicine.

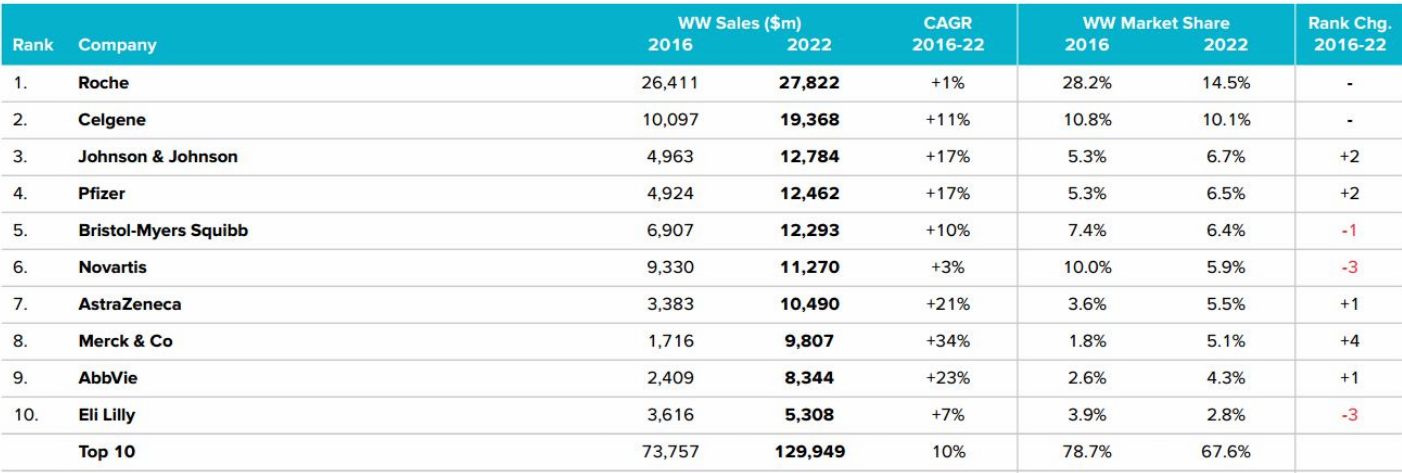

In 2016-2022, the oncology drug market will reach an astonishing $ 190 billion in 2022, doubling the 83.2 billion in 2016, three times the market for the second-largest disease, the diabetes market.

Drug Sales Trends of Pharmaceutical Enterprises to

Roche tumor line has encountered a bottleneck in the monoclonal antibody, whose growth rate is slow. However, the lean camel was bigger than the horse. Although the sales of three drugs, rituximab (CD20 monoclonal antibody), bevacizumab (VEGFR monoclonal antibody) and trastuzumab (HER2 monoclonal antibody), may fall out of the top five sales in the next two or three years, they can still firmly maintain the top fifteen.

Lenalidomide, the super blockbuster is able to keep Celgene busy in the cancer market.

At the same time, BDM’s Opdivo and MSD’s Keytruda started to lead the market of PD-1 / PD-L1 monoclonal antibody. Despite the strong momentum of Pfizer’s first CDK4 / 6 inhibitor Ibrance, Novartis’ imatinib encountered a patent cliff in the second phase, and its second place was replaced by Celgene, the company remains strong with many small molecule kinase inhibitors and monoclonal antibodies. Ibrutinib became the head of Abbive’s blood-based cancer line in the U.S. market, giving Abbive a strong rise in the cancer market. Johnson & Johnson got the commercial rights of Ibrutin of countries outside the United States, triumphantly all the way. AstraZeneca listed the first PARR inhibitor, and the first third-generation EGFR inhibitors, which also lead the market.

Top 10 Companies & Total WorldwideOncology Sales (2016-2022)

Top 10 Companies & Total WorldwideOncology Sales (2016-2022)

Drug R&D Trends

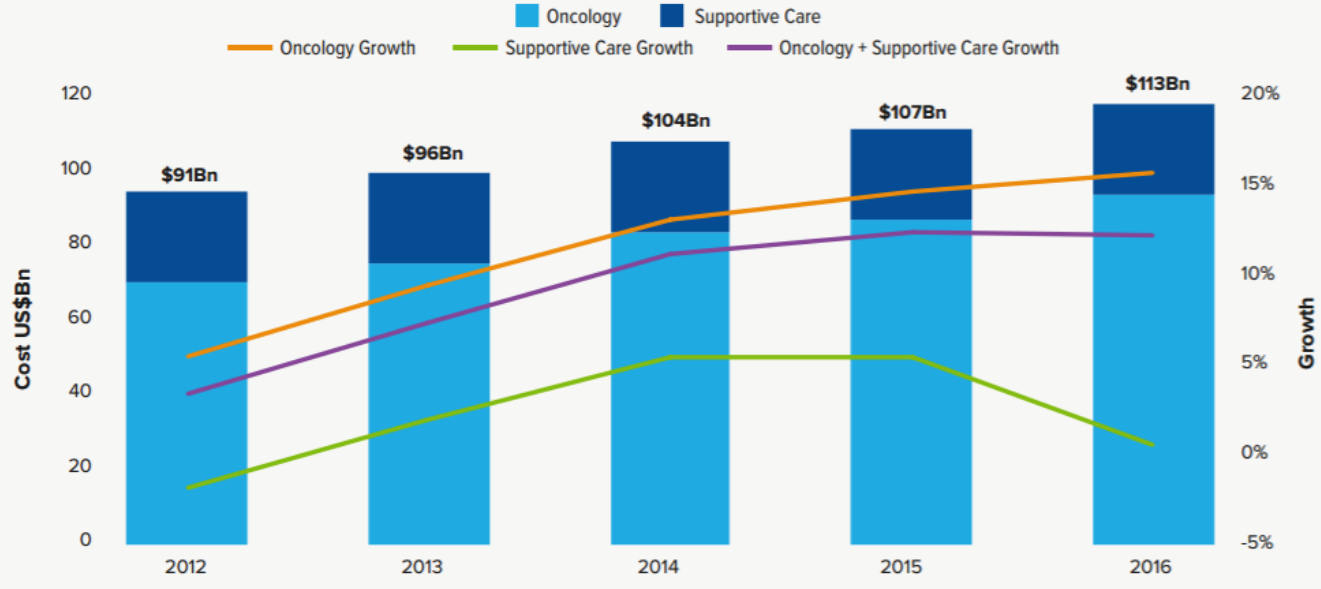

1. Increase in the cost of oncology drug treatment. In 2016, the global expenditure on oncology products and maintenance therapy was 113 billion U.S. dollars, increasing from 107 billion U.S. dollars in 2015. The increase mainly came from cancer treatment products. In 2016, the cancer treatment product market reached 89.6 billion U.S. dollars.

Global Oncology and Supportive Care Costs US$Bn

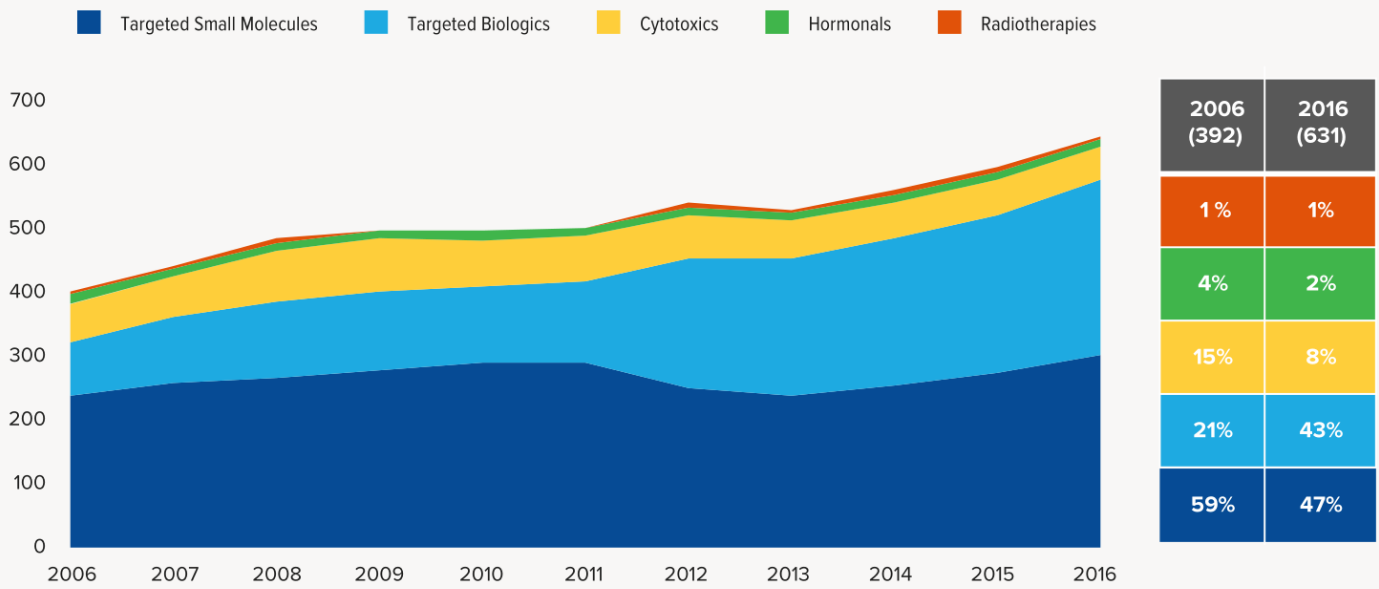

2. Bio-targeted drug R&D also went through the beginning of the gradual transition of antibodies to ADC antibody coupling drugs, antibodies, tumor immune and other multiple areas. Targeted tumor biotherapies are more diverse. The first oncology mAb, rituximab, was introduced in 1997 and the first tumor vaccine, HPV vaccine, was introduced in 2006. In 2011, the first antibody-conjugated drug was launched after 10 years. In 2017, CAR-T therapy went public.

3. Tumor immunotherapy has become the trend of the future, which is more excellent in clinical efficacy. It significantly improved the overall survival of patients in the approved indications. It is estimated that immunotherapy drugs will occupy half of the cancer treatment by 2022. Among them, the checkpoint inhibitor represented by PD-1 / PD-L1 will take the largest part. Not surprisingly, the top three drug sales are all immunotherapy.

4. Small molecule protein kinase inhibitors are still the mainstay of the drug in the tumor market. They will still maintain the number of 6 to 7 in the future.

5. According to the market performance, the early targeting of small molecule drugs targeting growth signals will be affected in some time in the future. The main factor is the limitation caused by the early expiration of patents targeting small molecule drugs. PD-1 / PD- L1 monoclonal antibody continues to expand its indications. Taking non-small cell lung cancer as an example, with the first-line treatment of Keytruda, the first-generation EGFR inhibitors will expire a few years later and will have some impact on the second and third-generation EGFR inhibitors listed later.

However, specifically developed inhibitors for apoptosis (Bcl-2 inhibitors), cell cycle regulation (CDK4, 6 inhibitors), DNA damage repair (PARR inhibitors), specific inhibitors (BTK inhibitors), tumor epigenetics and metabolism (HDAC, IDH inhibitors) became the new favorites of small molecule drugs.

6. Clinical trials pay attention to biomarkers. Cancer is no longer diagnosed as a single tumor type, but rather by a combination of factors including histology and biomarker status, and the core of treatment is slowly becoming personalized treatment approaching. More and more clinical trials stratify patient groups through predictive biomarkers, which can not only effectively screen the appropriate patient groups and improve the clinical efficacy, but also requires fewer patients to be recruited and shortens the later clinical phase of the time, which has a quite positive impact on drug development.

For example, Pfizer’s crizotinib, ALK kinase-positive non-small cell lung cancer, and Roche Vemurafenib were used to treat BRAF-positive metastatic melanoma in 2011. Both drugs were marketed with diagnostic reagents for their corresponding biomarkers. MSD has clinically classified PD-L1 and MSI as biomarkers for patients. In May of 2017, Keytruda won three consecutive indications and became the first-line agent for non-small cell lung cancer.

7. Tumor research and development are still focused on targeted therapies, accounting for 90% of the latest clinical research in 2016. Radiation therapy, cytotoxic drugs and hormonal drugs accounted for a decline. Thanks to the development of biotechnology, and CRO companies, the development cycle of biopharmaceuticals was greatly shortened. The rapid development of biopharmaceuticals doubled in ten years and slightly decreased the targeting of small molecule drugs.

References:

1.World Preview 2017, Outlook to 2022

2.Global Oncology Trends 2017 Advances, Complexity and Cost