According to the Journal of the American Medical Association, there were 15.4 million cancer patients worldwide in 2013. Among them, the cancer mortality rate in developing countries was higher than that of the developed countries. The number of cancer patients in developing countries accounted for 57% of the world with the death toll up to 65%. Because of the complexity of cancer treatment and the needs of patients, the anti-cancer drugs market is promising.

The initial anti-tumor drugs are mostly small molecule compounds. Since the emergence of monoclonal antibody drugs, the top best selling anti-tumor drugs were gradually replaced by them. By 2022, the current well-sold drugs will not be found in the tops of the list. According to Quintiles IMS, the top 15 best selling anti-tumor drugs are expected to reach $ 90 billion by 2022, which takes up a quarter of the US pharmaceutical market. During the next five years, there will be three PD-1 / PD-L1 or checkpoint inhibitors in the top 10 best selling drugs. By activating the immune system, this new anti-tumor drug can identify cancer cells and eliminate them. They have achieved unprecedented effects in the treatment of cancer.

Although the sales of tumor immunotherapeutic drugs rise, most of the top 10 best selling drugs in 2022 will still be monoclonal antibody drugs. However, their condition won’t be optimistic, as they will confront the competition of biological similar drugs in the next few years.

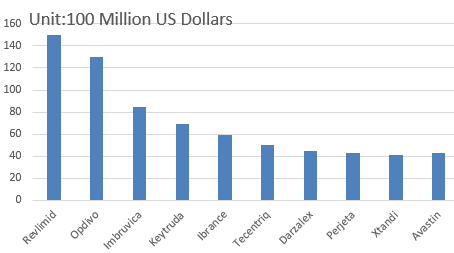

Top 10 Best Selling Anti-tumor Drugs in 2022

Top 10 Best Selling Anti-tumor Drugs in 2022

1. Revlimid

Revlimid is a chemical drug developed by Celgene Corporation with a current sales of $ 7 billion. It is expected to reach $ 15 billion by 2022, making it the best-selling anti-tumor drug and showing a great growth potential. Revlimid was approved by the FDA in 2005 for the treatment of myelodysplastic syndromes (MDS). In 2006, the FDA approved Revlimid’s new indication of treating multiple myeloma patients who have received at least one treatment with Dexamethasone. In 2013, FDA approved Revlimid’s supplemental new drug application for the treatment of mantle cell lymphoma (MCL) patients whose disease still relapses or develops after being treated with at least two drugs (one of which is bortezomib). By 2022, it is expected that the composite annual growth of this drug partly owes to new indications, such as follicular lymphoma and non-Hodgkin’s lymphoma (NHL). Lymphoma will become a major growth driver by 2020 and beyond. It is expected that the composite annual growth of this drug to 2022 is expected to be partly due to new indications such as follicular lymphoma and non-Hodgkin’s lymphoma (NHL). Lymphoma will become a major growth driver by 2020 and beyond.

2. Opdivo

Bristol-Myers Squibb’s Opdivo is the first PD-1 / PD-L1 inhibitor drug and was launched in Japan. In December 2014, the US FDA accelerated the approval of Opdivo for the treatment of advanced melanoma patients whose melanoma cannot be removed by operation or have already metastasized and fail to respond to other drugs. However, with the approval of Merck’s keytruda by the FDA, fierce competition appears between these two drugs. Although keytruda may be a stumbling block to Opdivo’s sales, Opdivo is still the best next-generation tumor immunotherapy drug. Currently, its indications are expanding, including non-small cell lung cancer, renal cell carcinoma, Hodgkin’s lymphoma and so on. Its annual sales in 2022 is predicted to reach 12.6 billion US dollars.

3. Imbruvica

Imbruvica, a BTK inhibitor co-developed by AbbVie and Johnson & Johnson, was approved by the US FDA in 2013 for the treatment of MCL and Waldenström macroglobulinemia. In addition, imbruvica takes up the leading position in the second-tier market of Lymphocytic leukemia (CLL). Its annual sales in 2022 is expected to reach 8.3 billion US dollars.

4. Keytruda

Of course, as the Opdivo’s opponent, Keydruda is not vulnerable. Although Keytruda is the first PD-1 / PD-L1 inhibitor launched in the US market, its sales are less than Opdivo. Keytruda maintains direct competition with Opdivo in melanoma, non-small cell lung cancer and head and neck cancer. It was approved by the FDA for the first-line NSCLC treatment, while Opdivo was not. The current situation may be reversed in the next few years. The same as Opdivo, Keytruda is expanding its indications, including multiple myeloma, Hodgkin’s lymphoma, breast cancer, and the roles in combination therapy, which is the very place where cancer immunotherapy drugs can really show their functions. It is expected that Keytruda’s sales will reach $ 6.5 billion in 2022.

5. Ibrance

Pfizer’s Ibrance is the first new CDK4/6 inhibitor, and was approved by the US FDA in 2015. CDK4/6 is a key regulator of cell cycle, which can trigger cell cycle progress. Combined with letrozole, it can be applied in hormone-receptor positive (HR+) and human epidermal growth factor receptor – 2 – negative (HER2 -) late menopausal breast cancer. Ibrance’s sales in 2016 grew rapidly, reaching almost 950 million US dollars in the first half of the year. Its sales are predicted to reach 6 billion US dollars in 2022.

6. Tecentriq

Roche’s Tecentriq is a PD-1/PD-L1 inhibitor and ranks third among immunotherapeutic drugs. In May 2016, the US FDA accelerated the approval of Tecentriq for the treatment of the most common types of bladder cancer (BC). BC is the world’s ninth most common cancer. Male incidence rate is 3 times higher than that of female, which brings Tecentriq a promising market potential. Meanwhile, Roche is expanding another indication of Tecentriq, non-small cell lung cancer. Its sales are expected to reach $ 5.53 billion in 2022.

7. Darzalex

In November 2015, Johnson & Johnson’s Darzalex injection was approved by the US FDA. Darzalex is used to treat patients with multiple myeloma who have previously received at least three treatments. Darzalex is the first monoclonal antibody injection approved for the treatment of multiple myeloma. Multiple myeloma is a blood cancer. In the United States, there are about 10,000 people died of multiple myeloma each year. Because of Darzalex’s outstanding performance, FDA awarded Darzalex breakthrough therapy designation, priority approval and orphan drug identification. It is estimated that Darzalex injection’s sales in 2022 will reach 4.91 billion US dollars.

8. Perjeta

Roche’s Perjeta was first introduced in 2012 and was approved by the US FDA in 2013. It is used as a dual strategy in reducing the volume of breast cancer cells combined with herceptin or docetaxel. The drug is also the first case approved by the FDA of reducing tumors’ volume rather than killing the tumors. Its sales are expected to reach $ 4.73 billion in 2022.

9. Xtandi

Xtandi, a drug for the treatment of prostate cancer, is acquired by Pfizer through the acquisition of Medivation which cost it $ 14 billion. Xtandi is a novel androgen receptor signaling inhibitor, which can be administered once a day. This drug can reduce the growth rate of cancer cells and induce the death of tumor cells. In September 2014, the US FDA approved Xtandi for the pre-chemotherapy treatment of prostate cancer, followed by its listing in the EU market. Owing to its advantages and good therapeutic effects, Xtandi has a broad market space. Its sales in 2022 are expected to reach $ 4.71 billion.

10. Avastin

Roche’s bevacizumab was approved by the FDA in 2004, and was the first drug to be approved for tumor angiogenesis in the United States as well as one of the first-line drugs for the treatment of colon cancer. Recently, it obtained European license for patients with EGFR-positive non-small cell lung cancer. Its sales in 2022 are expected to reach 4.68 billion US dollars.

Reference:

http://www.fiercepharma.com

http://www.drugs.com

Global Burden of Disease Cancer Collaboration