In this March, Bristol-Myers Squibb and Bluebird Bio announced that their CAR-T cell therapy idecabtagene vicleucel (Abecma) targeting B cell maturation antigen (BCMA) has been approved for the treatment of multiple myeloma, and Abecma has become the first approved CAR-T cell therapy for targets other than CD19. At present, there are 5 cell therapies approved, all of which are CAR-T cell therapy.

An analytical article published in Nature Reviews Drug Discovery on June 4 provides the latest vision in the field of cancer cell therapy, including global research and development (R&D) pipelines, the status of clinical trials, and real-world data showing their current use in clinical practice.

Steady Growth of R & D Pipelines

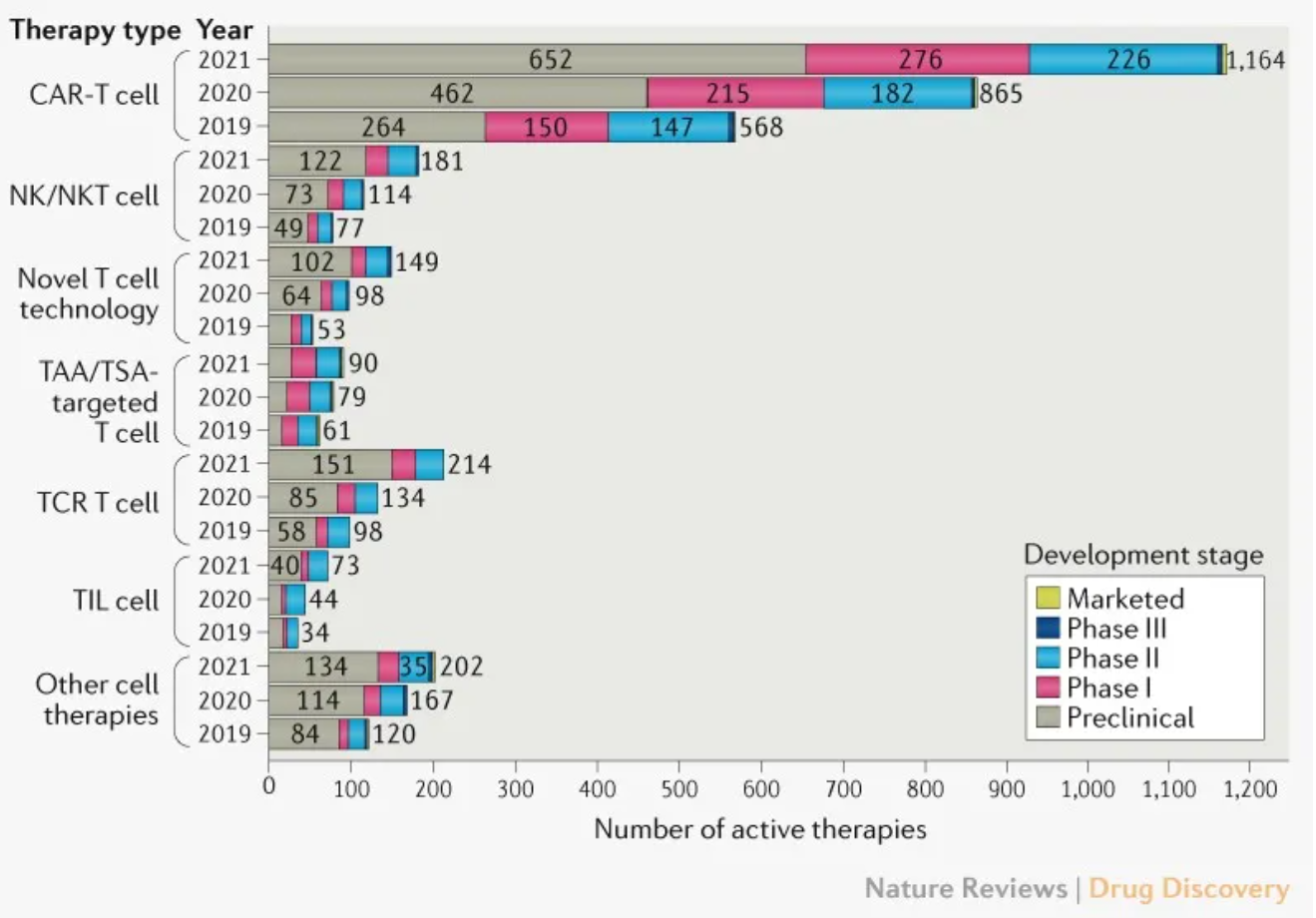

As of April 16, 2021, 2073 cell therapies in the global pipeline are marked as active, an increase of 572 over the update in 2020. Compared with a 48% growth between 2019 and 2020, the number is increased by 38% last year. CAR-T cell therapies continue to dominate among other types of cell therapies, with an increase of 35% and 299 new drugs added to the pipeline.

Most CAR-T cell therapies (80%) are in preclinical and phase I stages. The runner-up belongs to T cell receptor (TCR) -T cell therapies, with 80 new drugs, followed by NK (natural killer) /NKT (natural killer T) cell therapies (67) and novel T cell therapies (51).

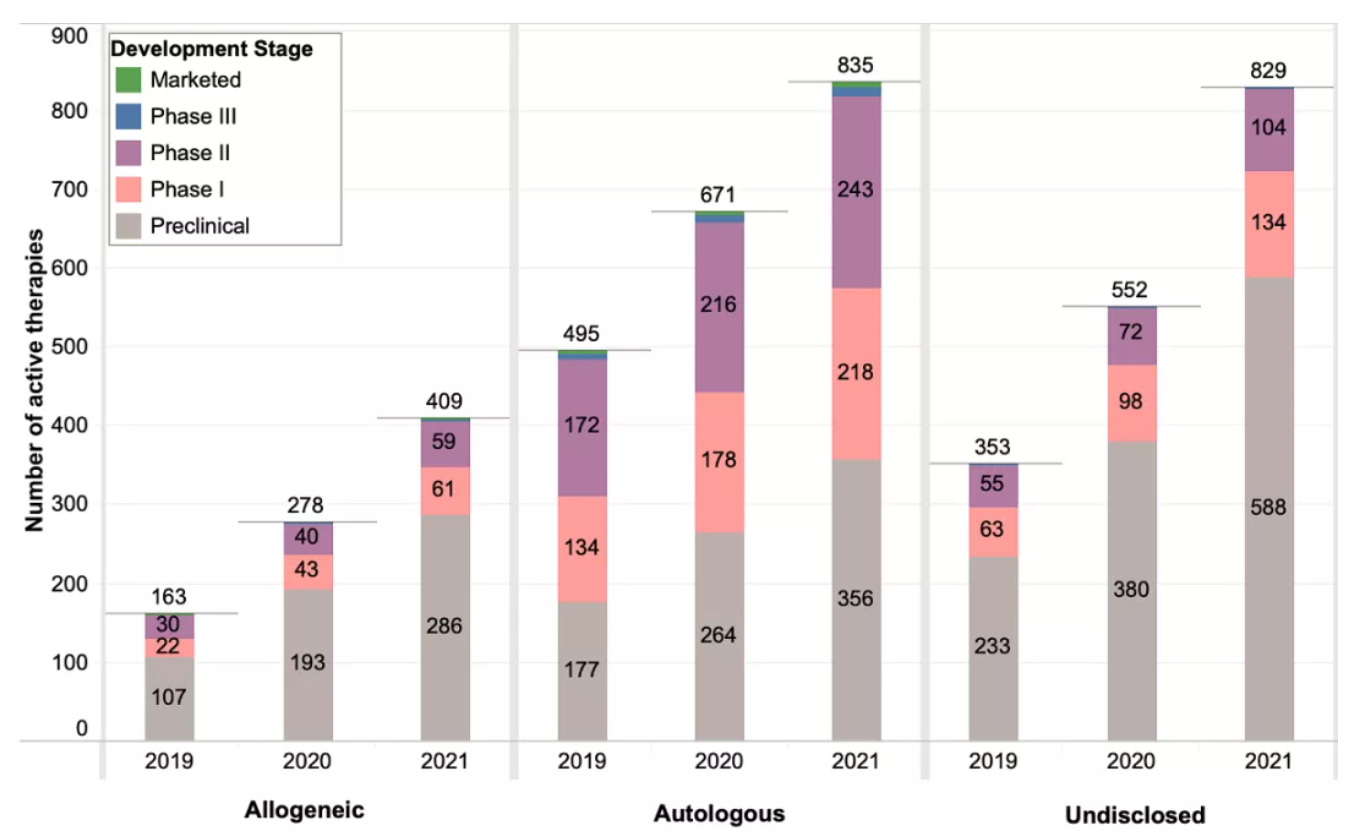

Most cell therapies are based on autologous cells (835), and there are twice as many autologous cell therapies in development as allogeneic cell therapies.

In the past year, the number of allogeneic cell therapies in preclinical and early clinical (phase I) development increased significantly (48% and 42%, respectively), but slower than the increase observed in the previous year (80% and 95%, respectively). However, the number of allogeneic cell therapies developed in phase II is higher compared to last year. Most phase II and later phase cell therapies outside the United States have not yet disclosed whether they are autologous or allogeneic.

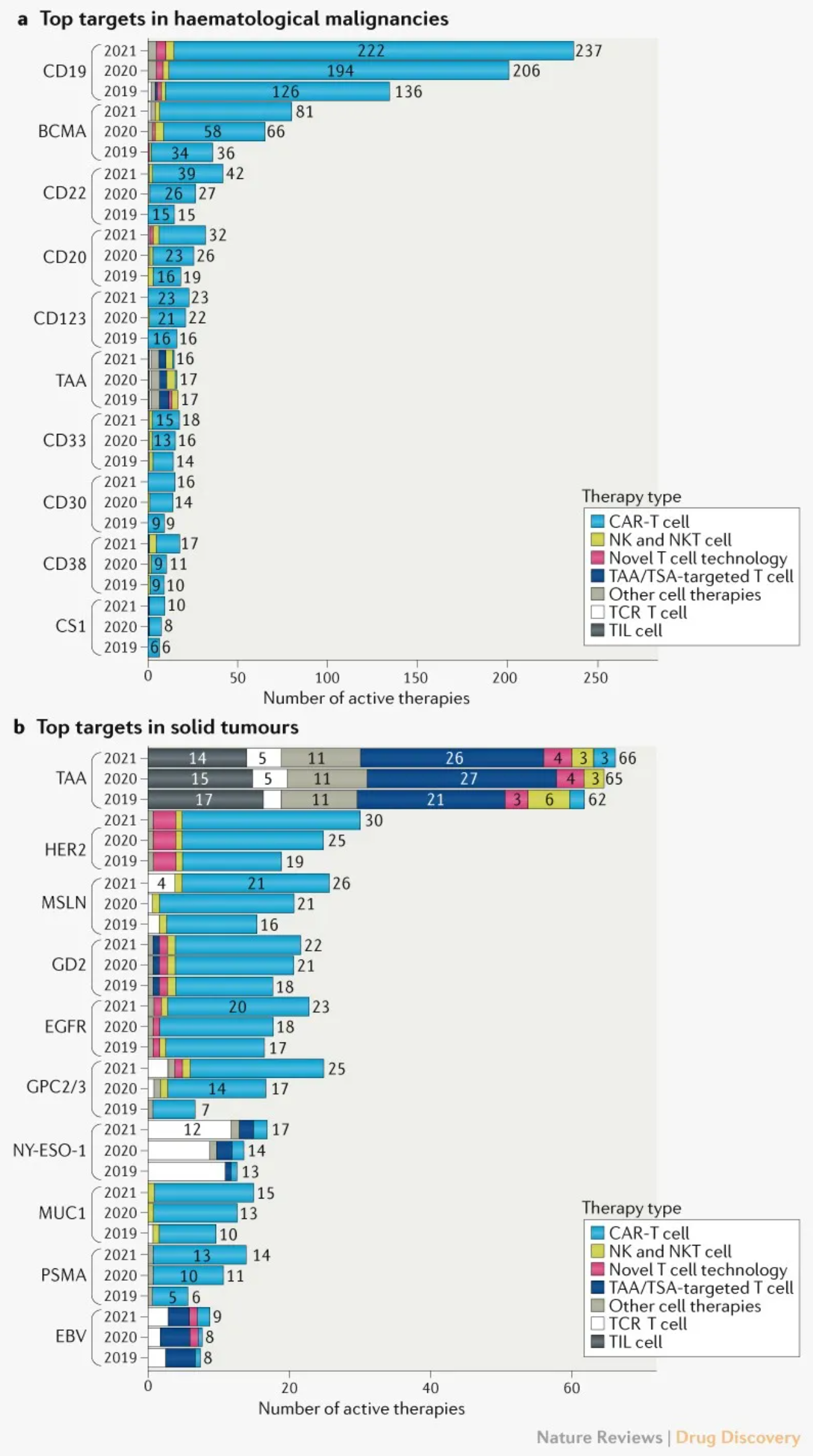

Analysis of the targets and pathways of cell therapy showed that CD19, BCMA, and CD22 are still the main targets of hematoma, but the number of drugs targeting these targets increased significantly in the past year compared with the previous year (51%, 83% and 80%, respectively). The increase in the past year was 15%, 23% and 56%, respectively. The reasons for the sharp decline in the number of targeted drugs year-on-year may include market saturation and the impact of COVID-19 on drug research and development.

The top solid tumor targets remained almost unchanged, with tumor associated antigen (TAA) in the first place. Most drugs for the treatment of solid tumors use enhanced CAR-T cells to overcome the challenges associated with the recognition, transport, and survival in the tumor microenvironment. It is worth noting that the development of cell therapy drugs targeting glypicans 2 and 3 (GPC2 and GPC3) has continued to grow rapidly, almost doubling every year since 2019. Because glypicans are highly expressed in hepatocellular carcinoma, most of the related drug activities are expressed in hepatocellular carcinoma.

A Survey of Cell Therapy Trials

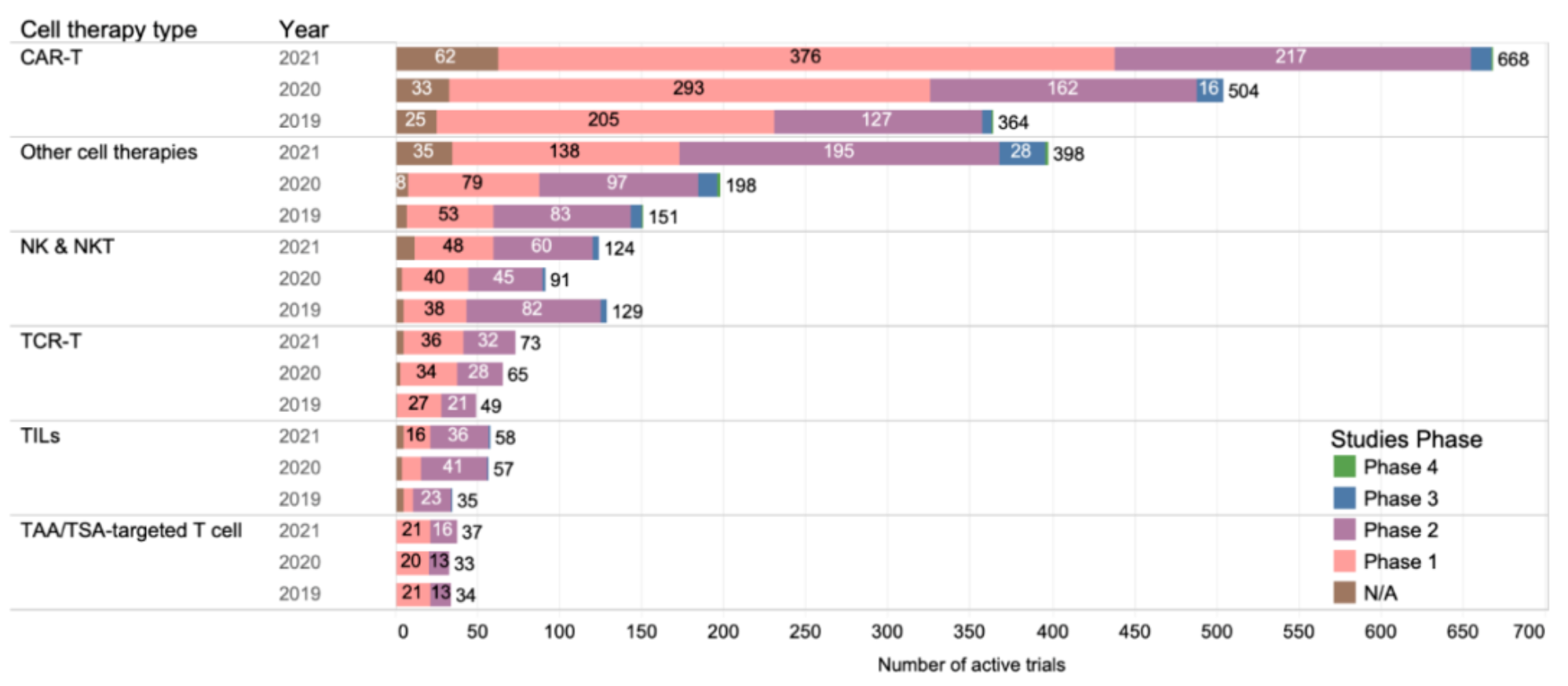

According to data provided by ClinicalTrials.gov, there were 1358 cell therapy trials in the active state as of April 2021, an increase of 43% from 2020 to 2021 compared with 24% growth from 2019 to 2020. Much of this increase is due to CAR-T cell clinical trials, which have increased by 83% since the 2019 update, and more trials have tested other cell therapies, TCR-T cell therapy and TIL (tumor-infiltrating lymphocyte) cell therapy. However, the number of NK/NKT cells has decreased and not fully recovered.

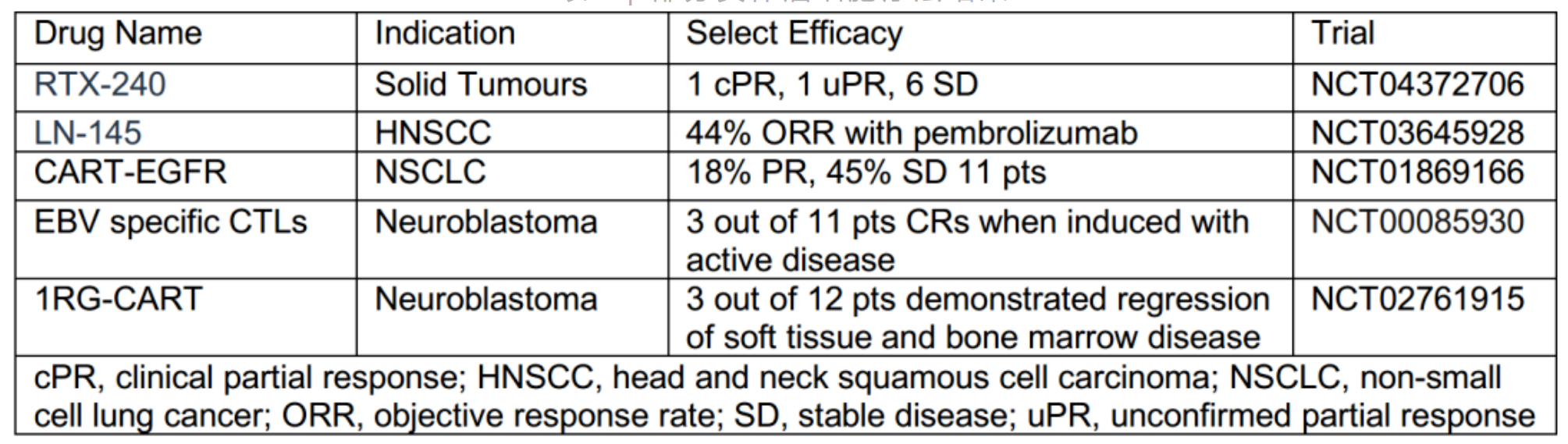

Similar to previous years, most trials focused on hematological malignancies, with solid tumors accounting for 40%, most of which were at an early stage. This may reflect the inherent challenges of solid tumor cell therapy. However, some recent early clinical data show hope.

Global Development of Cell Therapy Pipelines

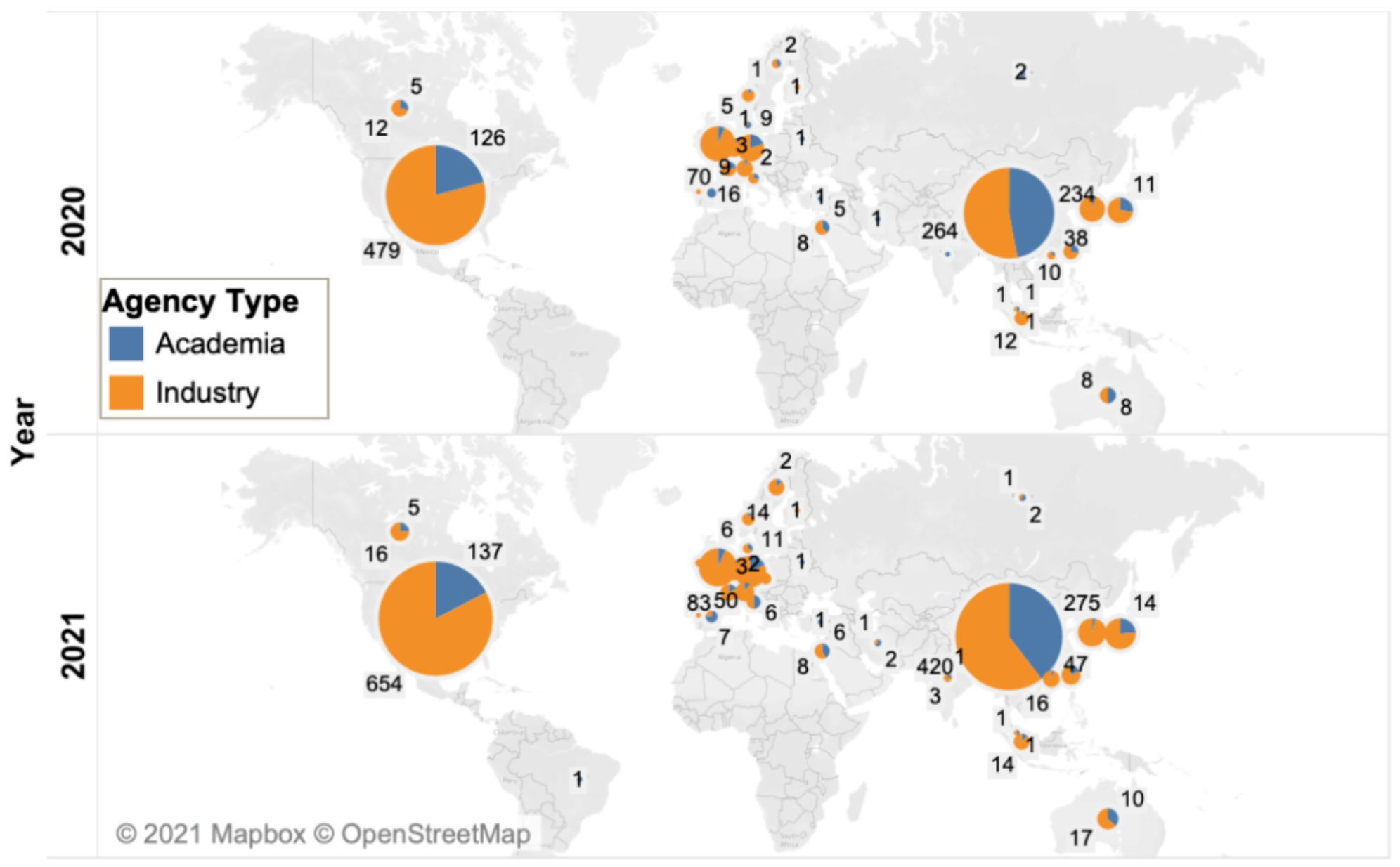

The United States and China continue to dominate the development of cell therapy, with 791 and 695 drugs in development, respectively. The cumulative number of cell therapies being developed in the United States and China increased by 31% and 40% respectively, compared with 40% and 69% increase between 2019 and 2020, consistent with the overall peak decline in the number of drugs (from 48% to 38%, as mentioned earlier).

The distribution of cell therapy products from academic institutions and industry in China and the United States is basically the same as the previous year: most drugs in the United States (83%) are developed in industry, while in China, the proportion is more average, 60% in industry and 40% in academia.

CAR-T Therapy

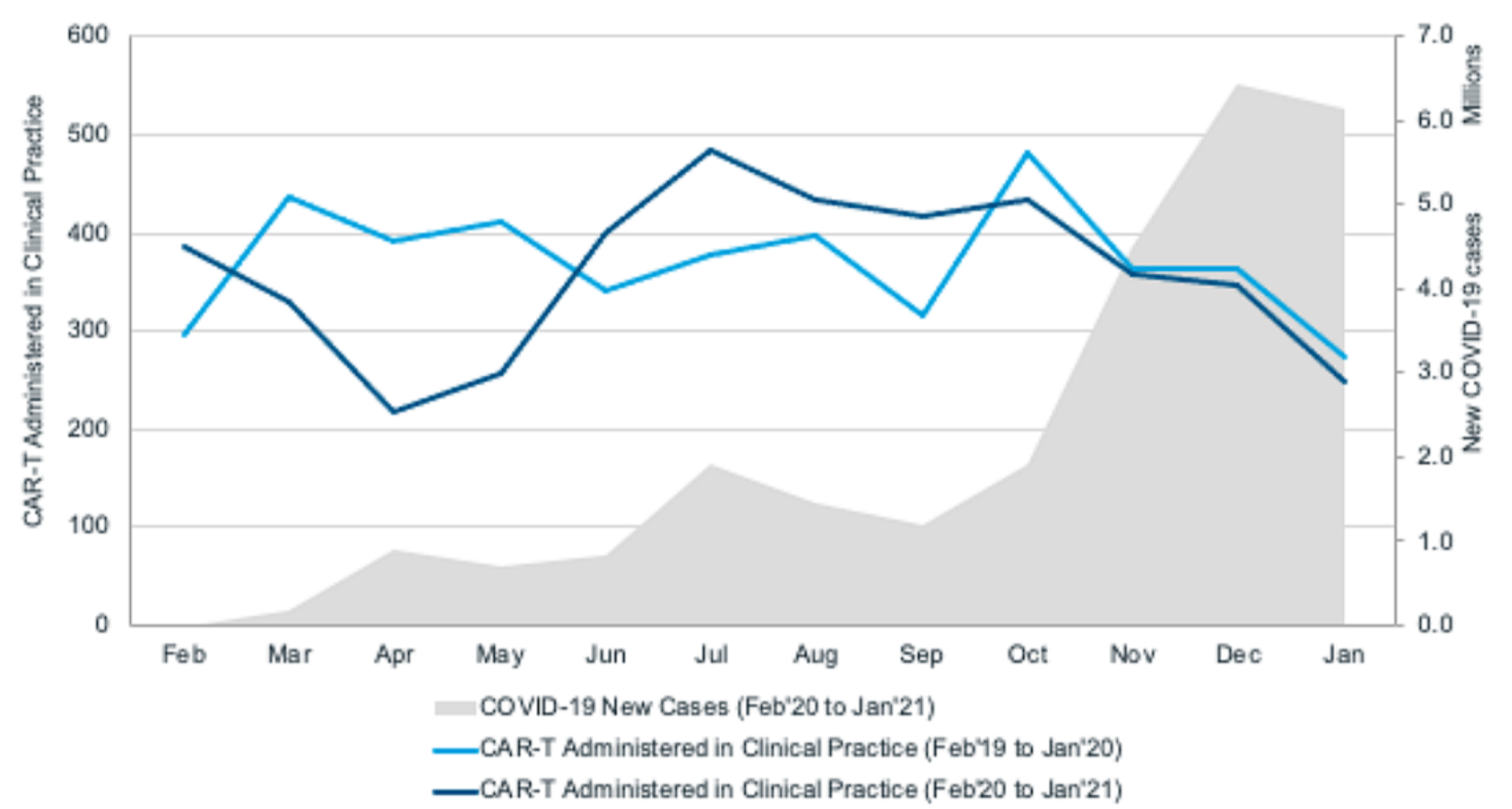

A significant decline was found in the number of patients receiving CAR-T cell therapy between March and April 2020, which coincided with the first wave of COVID-19 outbreaks in the United States. This may reflect the instability of the health care system in the early stages of the COVID-19 outbreak, reduced personnel and resources to support CAR-T cell therapy-related procedures, and the reluctance of patients with refractory diseases and medical staff to expose to potentially high-risk hospital environments.

Summary

Current analysis shows that although the rate is slower than in previous years, the clinical development of cell therapy continues. However, despite the increasing number of clinical trials of cell therapy, real-world data show a decrease in the number of patients receiving cell therapy in clinical practice, especially during the peak of the pandemic in 2020. With the stabilization of the COVID-19 pandemic and the evolution of the clinical, social, and economic situation, the number of cell therapy trials will continue to increase. In view of the continuous improvement of COVID-19 management and the continuous innovation in the field of tumor cell therapy, the prospect of cell therapy is promising.

Reference

1. Upadhaya, Samik, et al. “The clinical pipeline for cancer cell therapies.” Nat. Rev. Drug Discov 20 (2021): 503-504.