- Home

- Resources

- Knowledge Center

- Reviews

- Leading Innovators in the ADC Landscape

Leading Innovators in the ADC Landscape

ADC Companies with Strong Pipelines

The rapid evolution of antibody-drug conjugates (ADCs) as new anticancer medicines has propelled them to the most cutthroat arena in pharma R&D. As clinical applications keep broadening and commercializing, top pharma players are making strategic investments in establishing ADC pipelines. Some pivotal industry trends, including Pfizer's record $43 billion Seagen buyout and Ingen Therapeutics' out-licensing two ADC candidates to BioNTech, have radically fueled competition in this arena.

This acceleration of ADC development is driven by two strong imperatives, the unique therapeutic advantage of ADC platforms versus conventional treatments, and substantial market opportunity supported by evolving scientific breakthroughs. As a paradigm-shifting modality in targeted oncology, ADCs offer higher therapeutic value in their targeted delivery strategy with antibody specificity crossed with potent cytotoxic payloads. These pioneering discoveries of novel molecular targets also expanded novel fields of treatment and improved R&D pipelines in company environments. Industry predictions reaffirm this trend with the size of the ADC market predicted to achieve a 9.2% compound annual growth rate over the period between 2024 and 2030, affirming its substantial business viability.

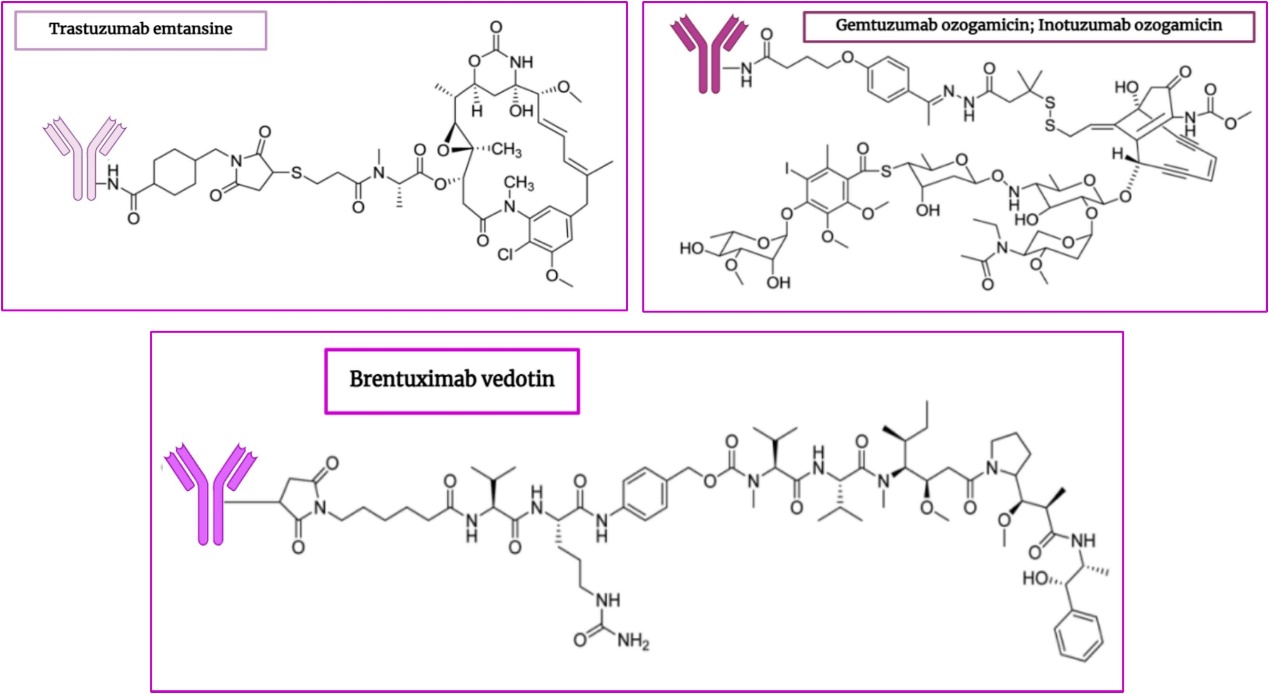

Fig. 1 Chemical structures of some ADCs in the clinical trial.1

Fig. 1 Chemical structures of some ADCs in the clinical trial.1

The following analysis examines key players driving innovation in ADC development, focusing on their technological platforms and strategic positioning within the global pharmaceutical landscape.

Roche's Strategic Advancements in ADC Drug Development

Roche, the pharmaceutical industry giant based in Switzerland, has emerged as a market leader in oncology, immunology, and diagnostics. Roche is the first pharma player to have achieved commercial success on the ADC route. With revenues of CHF 60.5 billion in 2024 and an innovation-driven mindset, Roche continues to drive the boundaries of targeted therapies, and most prominently, ADCs, which couple monoclonal antibodies with cytotoxic payloads for targeted cancer therapy.

Historical Context and Existing ADC Portfolio

Roche is a global leader in the field of anti-cancer and the first pharmaceutical company to achieve commercial success on the ADC track. Its first approved ADC is Kadcyla to treat HER2-positivemestatic breast cancer. The medication remains a flagship of Roche's oncology portfolio to this day, with more than $1.6 billion in sales in 2023. Building from its current foundation, Roche has continued to invest in ADCs through collaboration and internal research and development to address unmet medical needs in solid and blood cancers. Faced with the challenges of next-generation ADC drugs and competition from biosimilars, Roche chose to innovate technology through strategic cooperation to consolidate its leading position in the ADC market and demonstrate its R&D capabilities and commercialization strength in this field.

Pipeline and Collaborative Innovations

| Pipeline | Description |

| IBI3009 (DLL3-targeted ADC) | Developed in collaboration with China's Innovent Biologics, this ADC targets Delta-like ligand 3 (DLL3) for small-cell lung cancer (SCLC). Preclinical studies demonstrated potent antitumor activity, and Phase I trials are underway5. |

| Internal Pipeline | Roche is advancing RG6524, a trispecific antibody targeting DLL3, which may synergize with ADCs in SCLC. Additionally, its diagnostic division supports ADC development through biomarker identification and companion diagnostics. |

ADC Therapeutics in ADC Drug Development

ADC Therapeutics SA (ADCT), a first-to-market commercial-stage biopharma headquartered in Lausanne, Switzerland (founded 2011), concentrates on the creation of ADCs targeting hematologic malignancies and solid tumors. ADCT maintains vertically integrated discovery to commercial capabilities supported by three pillars of technology, a clinically validated pyrrolobenzodiazepine (PBD)-based conjugation platform, next-generation development platforms for enhanced therapeutic indexes, and vetted regulatory success with approved medicines. Through strategic capital allocation and partnered development initiatives, ADCT prioritizes pipeline acceleration and portfolio diversification, focusing on optimized payload-linker configurations and novel tumor-associated antigen targets.

Historical Development of ADC Therapeutics SA

The company has rich experience and advanced technology platform in the field of ADC drug development. Using its new pyrrolobenzodiazepine (PBD) dimer payload technology platform, ADC Therapeutics successfully developed loncastuximab tesirine-lpyl, a CD19-targeting ADC, which received FDA accelerated approval in April 2021 for third-line treatment of relapsed/refractory DLBCL. That aside, clinical development was significantly set back during Q2 2023 when the Phase II LOTIS-9 trial of Zynlonta combined with rituximab as initial DLBCL therapy was stopped following incidence of grade ≥3 adverse events with fatal outcomes among naïve patients. To improve overall global market coverage, the company put in place strategic licensing agreements such as the Q4 2022 deal with Swedish Orphan Biovitrum for non-U.S. commercialization rights.

The company's current research and development strategy centers on three synergistic objectives: systematic platform enhancement via linker-payload engineering to optimize therapeutic index and manufacturability, validation of emerging molecular targets (including AXL and DLK1) through high-throughput screening platforms incorporating AI-driven epitope mapping, and strategic advancement of a multi-modal oncology pipeline spanning six clinical-stage candidates (Phase I-III) and five preclinical assets targeting diverse tumor microenvironments across hematologic and solid malignancies.

Pipeline and Emerging Candidates

| Pipeline | Description |

| 9MW2821 | A Nectin-4-targeting ADC with FDA Fast Track designation for esophageal squamous cell carcinoma, showcasing China's innovation in novel targets. |

| SHR-A1912 | A CD79b-directed ADC for relapsed/refractory lymphoma, reflecting Hengrui's dual FDA Fast Track awards in 2024. |

| BL-M02D1 | A dual-antigen ADC in Phase III, underscoring the shift toward bispecific ADCs to overcome resistance. |

Astellas Pharma

Astellas Pharma focuses on its presence in the ADC space. Astellas Pharma Inc., with headquarters in Tokyo, Japan, is a world pharma leader committed to creating innovative therapies in oncology, immunology, urology, and rare diseases. Astellas boasts an extensive R&D network combined with a patient-first philosophy, where it emphasizes using real-world patient experience in the development of drugs, as testified by its Global Patient Centricity organization. The company has subsidiary entities such as Astellas Pharma US, which markets over 15 drugs in the United States, including the ADC Padcev.

ADC Development History

Perhaps considering that the individual R & D ADC cycle is too long, Astellas entered the ADC field through strategic cooperation and acquisitions. One of those approaches was that it collaborated with Seattle Genetics (now Seagen) to progress Padcev, an ADC targeting Nectin-4 in metastatic urothelial carcinoma. Padcev, which couples a monoclonal antibody to the cytotoxic payload monomethyl auristatin E, was approved in 2019 by the FDA and has induced lasting responses in refractory patients. For as much promise as Padcev holds, it is confronted with toxicity, highlighting the necessity of greater therapeutic indices in subsequent generations of ADCs.

AstraZeneca's Strategic Advancements in ADC Therapeutics

AstraZeneca was established through the strategic combination of Swedish drug developer Astra AB and its UK counterpart, Zeneca Group, in 1999, to form a multinational corporation with better therapeutic development capabilities. The corporate fusion generated enormous operation synergies, particularly in R&D pipeline diversification and in establishing a global commercialization network that facilitated accelerated innovation in pharmaceutical portfolios.

A defining moment occurred in 2007 with the acquisition of MedImmune, which is now the company's sole biologics research lab dedicated to novel therapeutic modalities. The company has important strategic areas of emphasis that are, oncology therapeutics, cardiometabolic diseases, and respiratory medicine.

Notably, the firm has expanded therapeutic interest to include investigational molecules in autoimmune diseases, neurologic diseases, and newly emerging infections. Through systematic pipeline development, AstraZeneca reports establishing a robust immuno-oncology portfolio with candidates spanning a variety of mechanisms of action, including multiple late-stage assets approaching clinical translation phases.

Approved ADC Enhertu

Whereas sales of most ADC drugs have registered encouraging growth, AstraZeneca's Enhertu is particularly notable. AstraZenaca's poster child ADC, Enhertu, has revolutionized the approach to cancer treatment. Used in HER2-positive breast, stomach, and non-small cell lung cancers, it received a record FDA tumor-agnostic approval in 2024 for HER2-positive solid tumors. Its global revenues in 2023 stood at $25.66 billion, double last year's performance. This came in response to increased indications and higher efficacy in relation to traditional medications. AstraZeneca's reliance on cooperative collaborations with outsiders and supported in-house R&D is what propels the success of Enhertu. Here are some of the company's pipelines.

| Pipeline | Description |

| Dato-DXd | A TROP2-targeted ADC, currently under FDA review for non-small cell lung cancer (PDUFA date: December 2024), with potential to become the first TROP2 ADC in this setting. |

| CMG901 | A Claudin 18.2-targeted ADC acquired from Lepu Biopharma, showing a 33% objective response rate (ORR) in gastric cancer Phase I trials and advancing to Phase III. |

| LM-305 | A GPRC5D-targeted ADC for multiple myeloma, acquired from LaNova Medicines, now in Phase I trials. |

| AZD8205 | B7-H4-targeted ADC with promising Phase I/II results in endometrial cancer (disease control rate >80%). |

| AZD5335 | FRα-directed ADC demonstrating robust preclinical efficacy in ovarian cancer models. |

| AZD9592 | Dual-targeting EGFR/c-Met ADC designed to overcome osimertinib resistance in NSCLC. |

Collectively, these developments position ADC-focused enterprises for sustained growth, supported by pipeline maturation trends. In the future, more and more new ADC drugs will be developed, and their market will be further expanded.

Creative Biolabs, a leader in targeted conjugate tech, offers customized solutions for next-gen therapeutic and diagnostic conjugates. Our services fall into three categories:

- Specialized Antibody Conjugates: Antibody-Antibiotic Conjugates (AAC) fight drug-resistant infections; Antibody-Enzyme Conjugates boost cancer treatment; Antibody-Biopolymer Conjugates (ABC) optimize drug delivery.

- Immunomodulatory & Nucleic Acid Conjugates: Deliver immunostimulants or oligonucleotides for immune activation and gene regulation.

-

Innovative Formats: Develop Fragment-Drug Conjugates (FDC), antibody-based probes, and Bispecific ADCs.

With full - cycle support, we help accelerate your R&D. Contact us for tailored solutions!

References

- Akram F, Ali A M, Akhtar M T, et al. The journey of antibody-drug conjugates for revolutionizing cancer therapy: A review. BIOORGAN MED CHEM 2024, 118010. https://doi.org/ 10.1016/j.bmc.2024.118010

- Choi Y, Choi Y, Hong S. Recent Technological and Intellectual Property Trends in Antibody–Drug Conjugate Research. Pharmaceutics 2024, 16, 221. https://doi.org/10.3390/pharmaceutics16020221

- Timmins P. Industry update: The latest developments in the field of therapeutic delivery, October 2023. Therapeutic Delivery 2024, 15(2): 77-94. https://doi.org/10.4155/tde-2023-0139

- Bhushan A, Misra P. Economics of antibody drug conjugates (ADCs): innovation, investment and market dynamics. Current Oncology Reports 2024, 26(10): 1224-1235. https://doi.org/10.1007/s11912-024-01582-x

For Research Use Only. NOT FOR CLINICAL USE.

Online Inquiry

Welcome! For price inquiries, please feel free to contact us through the form on the left side. We will get back to you as soon as possible.