In recent years, cell and gene therapy (CGT) has developed rapidly in the global medical industry, and has become the third generation of therapeutic technology after small molecule drugs and biological agents. According to the forecast of FDA, by 2025, 10-20 CGT products will be approved for listing every year. The breakthrough in this field is mainly due to the continuous maturity of gene editing technology (such as CRISPR-Cas9), virus vector delivery system (such as AAV and lentivirus) and immune cell therapy (such as CAR-T). Specifically, the progress of gene editing technology makes it possible to modify the gene sequence accurately, the optimization of virus vector system improves the delivery efficiency of therapeutic genes, and the iteration of immune cell therapy provides a new path for the treatment of tumors and other diseases. The coordinated development of these technologies is pushing CGT from laboratory research to clinical application.

From a commercial point of view, the CGT market has great potential. The global Cell and Gene Therapy (CGT) CDMO market demonstrated remarkable momentum in 2023, with its size valued at approximately USD 5.90 billion. Projections indicate that this market will undergo exponential expansion over the next decade, with expectations to reach USD 69.11 billion by 2033. This growth trajectory is underpinned by a robust compound annual growth rate (CAGR) of 27.9% during the forecast period from 2024 to 2033. Its high value is reflected in the radical cure potential of traditional refractory diseases (such as cancer, hereditary diseases and rare diseases).

The CGT market has significant commercial value. In 2023, the global CGT CDMO market reached $5.9 billion. It's expected to keep growing at a compound annual rate of 27.9%, and is projected to surpass $69.1 billion by 2033. The key value of this field is its potential to cure traditionally hard-to-treat diseases like cancer, genetic disorders, and rare diseases.

The manufacture of CGT products is completely different from traditional drugs, and its core challenge lies in the personalized treatment of living cells and strict quality control standards.

The manufacturing of CGT products requires strict infrastructure. Firstly, it is necessary to meet the good manufacturing practice (GMP) standards, especially the clean workshop with B/A aseptic environment, to ensure that there is no microbial pollution in the production process. Secondly, professional equipment is indispensable, such as bioreactor for cell amplification, flow cytometry for cell phenotype analysis, and gene sequencer for detecting gene sequences. In addition, automation systems have gradually become the mainstream, such as closed cell processing systems, which can effectively reduce human operation errors and improve mass production capacity.

Tab.1 Key Facilities and Equipment Requirements for Cell Therapy Production

| Infrastructure Type | Specific Requirements & Equipment | Function |

| Cleanroom | Grade B/A Sterile Environment | Prevents microbial contamination |

| Specialized Equipment | Bioreactors, Flow Cytometers, Gene Sequencers | Cell expansion, phenotypic analysis, genetic testing |

| Automated System | Closed Cell Processing System | Reduces human error, increases production capacity |

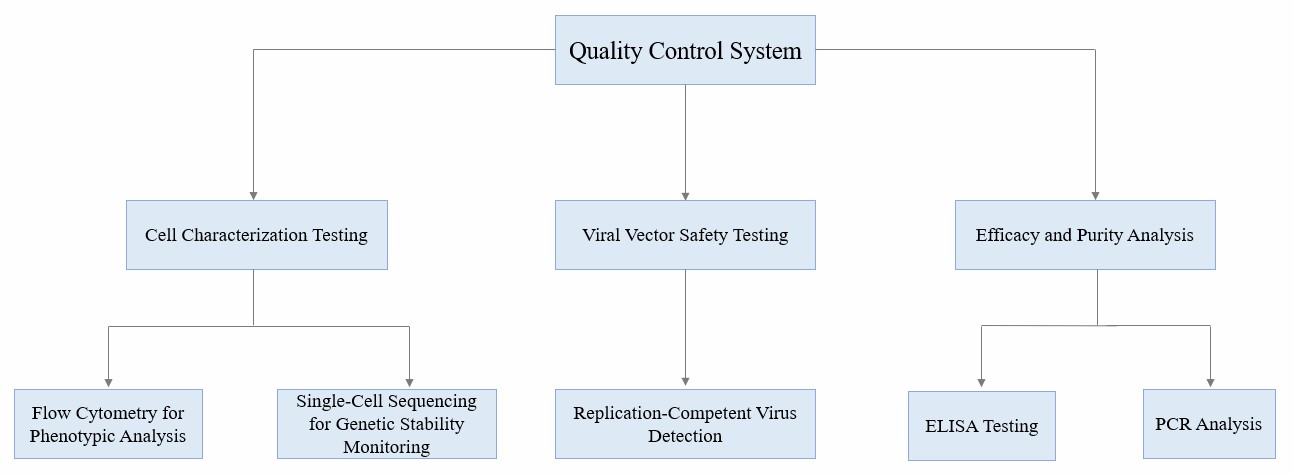

In addition to infrastructure requirements, the manufacturing of CGT products also needs to follow strict QC (Quality Control) and QA (Quality Assurance) processes, including: detection of cell characteristics (such as phenotype and genetic stability); Virus carrier safety testing (such as replication virus detection); Efficacy and purity analysis (such as ELISA, PCR).

Fig.1 Flow chart of CGT product quality control.

Fig.1 Flow chart of CGT product quality control.

According to the research data in 2024, the global market size of CGT Contract R&D and Production Organization (CDMO) has exceeded US$ 5.1 billion in 2023, an increase of 21.4% compared with 2022, significantly higher than the previous forecast of 18.5%. This unexpected growth is mainly attributed to three factors:

First, technical iteration accelerates the commercialization of clinical projects. The control accuracy of off-target effect of CRISPR-Cas gene editing technology is improved to 99.7%, and the efficiency of large-scale production of virus vectors is improved by 3-5 times, which makes the CGT project entering phase III clinic worldwide increase by 42% in 20231. For example, the demand for CDMO services of a new AAV vector surged by 60% in 2023, pushing the market share of virus vectors to 58%.

Secondly, industry integration has spawned outsourcing demand. Small and medium-sized biotechnology companies face FDA's stringent CGT production site review standards (the pass rate is less than 35%), and instead outsource more than 70% of the process development to CDMO enterprises. At the same time, large pharmaceutical companies improve the industrial chain by acquiring the CDMO platform. For example, a multinational pharmaceutical Creative Biolabscquired CGT CDMO Company for US$ 1.2 billion in 2023, which directly led to a 30% increase in the order volume of head CDMO enterprises.

Finally, favorable policies release market potential. The EU's "Regulations on the Management of Advanced Therapy" simplifies the examination and approval process, making the annual growth rate of the European CGT CDMO market reach 24%.

The market competition pattern is diversified, with head enterprises occupying a dominant position by virtue of the service capability of the whole industry chain, while emerging CDMO enterprises seize market segments through differentiated technologies (such as virus vector optimization platform). Some industry leaders integrate resources through mergers and acquisitions to strengthen their advantages in key areas such as virus vector production.

A CAR-T product is a model of successful commercialization. From the manufacturing end, the product adopts the mode of "central laboratory production + local cold chain distribution" to ensure that patients around the world get consistent quality products; In the clinical research stage, through strict admission criteria and efficacy evaluation, it was accelerated by the regulatory authorities; In the commercialization stage, enterprises cooperate with insurance institutions to launch the "pay according to curative effect" model, which effectively solves the payment problem. This series of measures enabled the product to quickly occupy market share after listing, with sales exceeding $1.2 billion in 2023.

The commercialization of CGT is restricted by many factors such as technology, economy and supervision. At the payment level, high prices are in contradiction with the existing medical insurance system. A survey of 200 insurance companies in the United States shows that only 15% of commercial insurance completely covers the cost of CGT treatment; The European Union's White Paper on CGT Payment 2023 pointed out that 60% of the member countries delayed the inclusion of CGT in medical insurance due to financial pressure. Take Zelenska (gene therapy for spinal muscular atrophy) as an example, its pricing of $2.1 million has caused global controversy, resulting in the actual penetration rate being less than 30% of the target patient group. In terms of market acceptance, there is a double gap between clinical cognition and public science popularization. Oncologists do not fully understand the mechanism of CAR-T therapy, which affects their clinical decision-making. The public's concern about the "ethical risk" of gene editing (such as off-target effect) led 28% patients to refuse to try CGT treatment.

At the regulatory level, differences in global standards significantly increase the complexity of commercialization. There are differences among FDA, EMA and NMPA in China on some key indicators, such as cell source traceability and virus vector residue standards. For example, the FDA requires that the residual DNA of viral vectors be less than 100 copies/dose, while the EMA standard is 500 copies/dose. This difference forces enterprises to invest an additional 30-50% of the cost for multi-regional declaration, thus delaying the product listing process.

Facing the multiple challenges of CGT commercialization, the industry has explored a series of effective solutions and achieved remarkable results in practice.

Through technological innovation and technical substitution, the production cost is significantly reduced. For example, the non-viral transfection technology developed by a research team (such as transposon system) reduced the production cost of CAR-T cells by 40%2, and shortened the production cycle from 21 days to 10 days. In addition, the extensive application of disposable bioreactor, microcarrier culture and other technologies has also greatly reduced the cost of equipment maintenance and cleaning.

Multi-party cooperation to explore innovative payment models to improve patient accessibility. The United States has introduced the "installment payment + curative effect guarantee" model, in which patients can pay the treatment fee in five years, and if the expected curative effect is not achieved, part of the fee will be refunded. The European Union has established a "value-oriented payment" system, and paid by stages according to the indicators such as the extension of patients' life span. At the same time, some countries have incorporated CGT into commercial insurance and social medical insurance. For example, Japan has incorporated various gene therapies into national health insurance, with a reimbursement rate of 70%, significantly reducing the burden on patients.

Enhance the market recognition of CGT through academic promotion and public science popularization. The International Association for Cell and Gene Therapy (ISCT) has launched a global doctor training program, which has covered more than 12,000 clinicians and significantly improved their understanding and application ability of CGT technology. At the public level, enterprises cooperate with non-profit organizations to popularize the therapeutic principle and safety of CGT to the public through online popular science videos and offline lectures, effectively reducing the public's misunderstanding and resistance to gene editing technology.

The industry actively promotes the coordination of international regulatory standards. The FDA, EMA, NMPA and other institutions have negotiated the quality, safety and effectiveness standards of CGT products through ICH, with the aim of gradually narrow the regional differences. At the same time, enterprises and regulatory agencies should establish an early communication mechanism to solve technical problems in the declaration in advance and shorten the approval period.

In the future, CGT manufacturing will develop towards automation and intelligence, and AI-driven real-time quality control system will further improve production efficiency and product quality. In terms of commercialization, as technology matures and costs drop, more products will enter the medical insurance catalogue, benefiting more patients. From the perspective of industry structure, CGT will promote the transformation of medical and health industry from "symptomatic treatment" to "precise cure" and reshape the whole medical ecology.

As the frontier technology in the medical field, cell and gene therapy is in a high-speed development stage with its remarkable therapeutic effect and broad market prospect. From the perspective of manufacturing, strict infrastructure requirements and quality control system are the key to ensure the safety and effectiveness of products; In terms of business transformation, although it faces many challenges such as cost, payment and market awareness, successful examples have emerged through technological innovation, model exploration and multi-party cooperation. Looking forward to the future, with the continuous breakthrough of technology and the continuous improvement of industrial ecology, CGT is expected to break through the bottleneck of development, play greater value in the medical and health field, bring more hope for patients, and at the same time, it will profoundly change the competitive pattern and development direction of the pharmaceutical industry.

References

For any technical issues or product/service related questions, please leave your information below. Our team will contact you soon.

All products and services are For Research Use Only and CANNOT be used in the treatment or diagnosis of disease.

NEWSLETTER

NEWSLETTER

The latest newsletter to introduce the latest breaking information, our site updates, field and other scientific news, important events, and insights from industry leaders

LEARN MORE NEWSLETTER NEW SOLUTION

NEW SOLUTION

CellRapeutics™ In Vivo Cell Engineering: One-stop in vivo T/B/NK cell and macrophage engineering services covering vectors construction to function verification.

LEARN MORE SOLUTION NOVEL TECHNOLOGY

NOVEL TECHNOLOGY

Silence™ CAR-T Cell: A novel platform to enhance CAR-T cell immunotherapy by combining RNAi technology to suppress genes that may impede CAR functionality.

LEARN MORE NOVEL TECHNOLOGY NEW SOLUTION

NEW SOLUTION

Canine CAR-T Therapy Development: From early target discovery, CAR design and construction, cell culture, and transfection, to in vitro and in vivo function validation.

LEARN MORE SOLUTION